Carnegie Hall chairman is in tax trouble

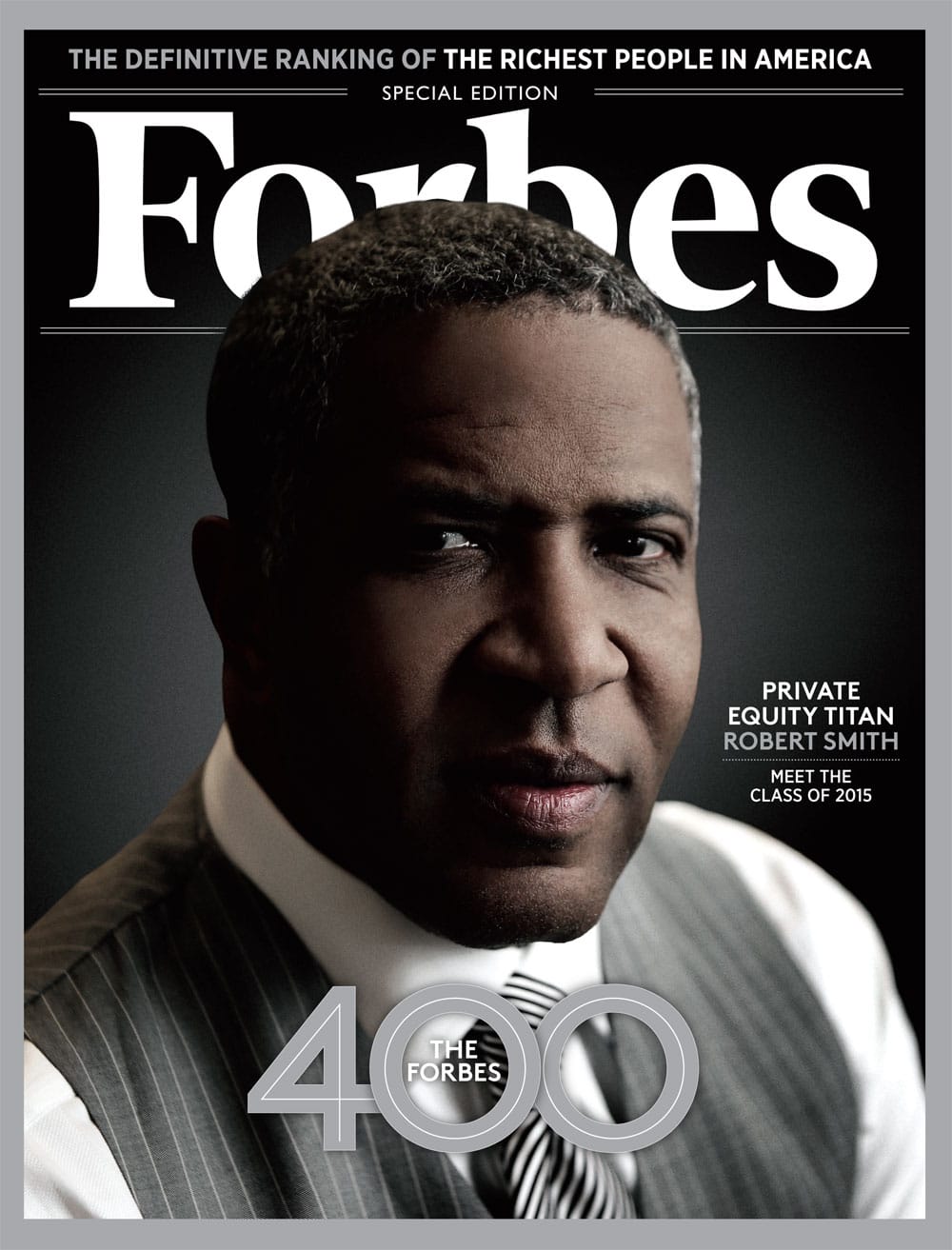

mainThe Carnegie Hall board says it is standing by its chairman Robert F. Smith, who has admitted failing to report some $200 million of income to the I.R.S..

Sort of thing that could slip anybody’s mind. NY Times has the full story.

Comments